CIC’s success is directly related to the investments of Chicago area institutions, who have made long-term commitments to CIC loan programs.

Investor Relations

Real Return. Real Impact.

At the core of CIC’s sustained success over the past 50 years are the partnerships with financial institutions, government, and philanthropic institutions. Beginning with $17.5 million in commitments from 14 investors, CIC has grown to $322 million in commitments from 37 investors. In addition to growing in size, CIC has expanded and diversified its investor and funding pool to include not only multifamily investors, but also investors in the Opportunity Investment Fund, Program Related Investments (PRIs) and other investment vehicles.

Invest in CIC

Contact us to learn more about making an investment with CIC.

Investors

CIC loan programs are made possible by the investments of nearly 40 financial institutions, government, and philanthropic partners.

- JPMorgan Chase Bank

- The Northern Trust Company

- BMO Harris NA

- Providence Bank and Trust

- Fifth Third Community Development Company LLC

- PNC Community Development Company, LLC

- Associated Bank

- Old National Bank (Acquired First Midwest Bank)

- Huntington Community Development Corporation

- First Eagle Bank

- Amalgamated Bank of Chicago

- CIBC

- First Bank and Trust Company of Illinois

- First American Bank

- First Savings Bank of Hegewisch

- Byline Bank (Acquired Inland Bank and Trust)

- Wintrust Bank

- Wintrust – Lake Forest Bank and Trust Company

- Forest Park National Bank & Trust Company

- Wintrust- Northbrook Bank and Trust Company

- First Bank Chicago (fka First Bank of Highland Park)

- Wintrust – Old Plank Trail Community Bank

- Wintrust – Hinsdale Bank & Trust Company

- Wintrust – Barrington Bank and Trust Company

- Byline Bank

- Liberty Bank for Savings

- International Bank of Chicago

- First National Bank of Brookfield

- Evergreen Bank Group

- Lakeside Bank

- Devon Bank

- Wintrust – Beverly Bank and Trust

- Wintrust – Wheaton Bank and Trust

- Old Second National Bank (Acquired West Suburban Bank)

- Old Second National Bank

- Huntington National Bank (Acquired TCF)

- Republic Bank of Chicago

- Burling Bank

- Heartland Bank and Trust Company

- CIBC

- BMO Harris

- Fifth Third Bank

- The Northern Trust Company

- Huntington Bank

- Byline Bank

- City of Chicago

- U.S. Department of Treasury Capital Magnet Fund

- City of Chicago

- Illinois Housing Development Authority

- Federal Home Loan Bank of Chicago

- U.S. Department of the Treasury

– CDFI Fund

– Capital Magnet Fund - MacArthur Foundation

- ComEd

- Energy Foundation

- The Chicago Community Trust

- Polk Bros. Foundation

- JPMorgan Chase Foundation

- Wells Fargo

- U.S. Bank

- Harris Family Foundation

- Chan Zuckerberg Initiative

- Circle of Service

- Movement Strategy Center

CIC is a certified Community Development Financial Institution (CDFI) and is a member of the Federal Home Loan Bank of Chicago.

How It Works

Banks participate in CIC’s Multifamily Loan Program via a unique concept – the Note Purchase Agreement (NPA).

Originally created in 1984, and amended many times over the years to adapt to changing conditions, the NPA is a proven, effective, and efficient vehicle for investors to participate in CIC loan programs.

The NPAs provide a predictable source of long-term capital for acquisition and rehabilitation of affordable housing, and they offer banks a unique opportunity to support low and moderate income communities.

Why Invest in CIC

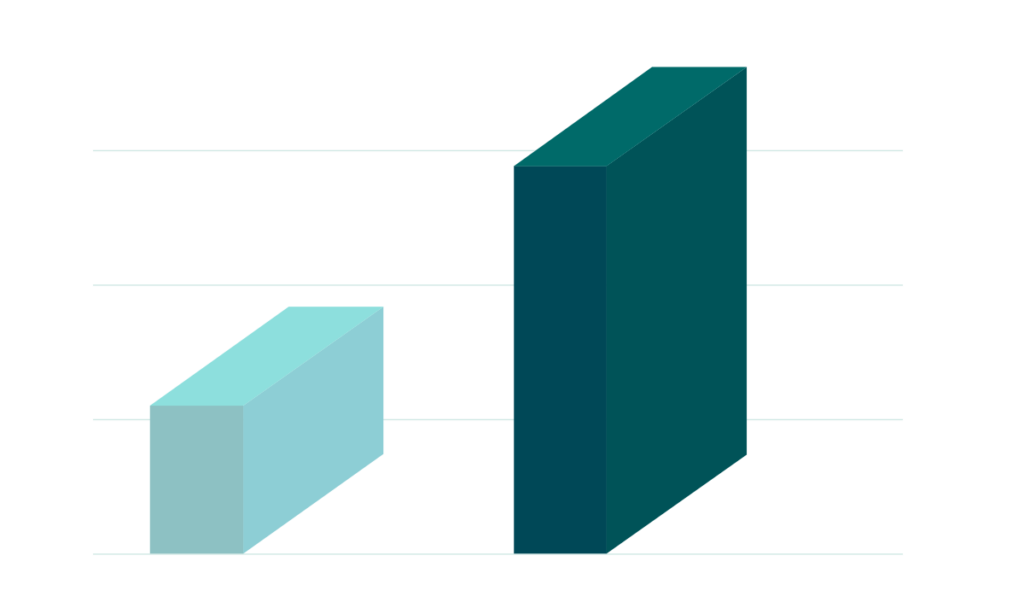

CIC is the largest lender for multifamily rental housing in low and moderate income Chicago neighborhoods. CIC loans perform better than other lenders, and have provided 35 years of positive returns to investors.

Overall, CIC’s multifamily lending has significantly outperformed other lenders.

Overall Share of Small Multifamily Mortgages with a Foreclosure (2005 to 2017)

*DePaul Institute for Housing Studies. Report on CIC lending activity and performance in CIC markets.

Experienced

CIC staff, board, and loan committee members have decades of lending and community development experience.

Prudent, Cautious, Conservative

Skilled loan officers carefully underwrite loan proposals to ensure good performance and low default rates. Loan committees review and approve proposals and ensure compliance with CIC lending policies.

Strong Relationships

Strong relationships with government, academic, and philanthropic institutions, as well as the private sector, broaden CIC’s reach, maximize results, and lead to responsive and innovative programs.

Solid Returns

CIC consistently delivers social impact—rehabilitation and preservation of affordable rental housing and community development—as well as economic returns to investors.

Comprehensive Approach

Beyond the financial transactions, CIC assists borrowers throughout the loan process and provides information and resources to strengthen property management. CIC’s complementary programs—buying and selling distressed properties and pursuing code enforcement on troubled buildings—create an environment that supports the long-term success of CIC investments.

Invest in CIC

Contact us to learn more about making an investment with CIC.

Documents and Reports

Financials and Reports

CIC publishes an annual Performance and Credit Review Report, and yearly audited financial statements.

- Audited Financials FY2025

- Annual CIC Performance and Credit Review Reports (PCR)

2025 2024 2023

Term Sheets

Learn more about the structure and impact of making an investment in CIC.

Leadership and Planning

Documents related to CIC’s governance and strategic planning.