Building better neighborhoods is what CIC is all about. We do this by providing financing in areas that need it most, and by helping our customers achieve their business goals. Under the CIC roof you will find a one-stop shop for financing, construction oversight, and servicing assistance.

Get started

loan options

For more than 30 years, multifamily lending has been CIC’s core business. Our multifamily acquisition, rehab, and refinance loans are for properties with five or more units. Get expert construction advice and personalized, hands-on customer service.

Term

10 years

Amortization

25 years

Loan-to-value

Up to 80%

Debt coverage

1.25 minimum

Security

First mortgage on the property

Prepayment

No prepayment penalty

Recourse

Full recourse to the borrower

Service area

Chicago, suburban Cook County, DuPage, Kane, Lake, McHenry, and Will Counties

Eligible Properties

Multifamily (5+) units, mixed-use, cooperatives, SROs and special needs housing

Featured Project

- Six units in Auburn Gresham

- Acquisition loan

Willette Henderson and Gregory Thomas came to CIC for acquisition financing as experienced building managers and repeat CIC customers. The well-maintained property, which they closed on in September, provides three 2-bedroom and three 3-bedroom units in the Auburn Gresham community, all projected to be affordable for residents earning 60% of area median income.

Like many CIC customers, Ms. Henderson and Mr. Thomas both have full-time employment outside of real estate. Mr. Thomas attended CIC’s Property Management Training several years ago, where, as he explains, he “…picked up new information on building maintenance and property tax assessments, even as an experienced building owner.” Together, he and Ms. Henderson will provide hands-on attention to all aspects of building management and maintenance.

The next order of business for this couple is to complete a number of energy and water efficiency upgrades to the building. Ms. Henderson and Mr. Thomas plan to make building wide improvements such as blown-in insulation, as well as upgrades to individual units such as installation of low-flow toilets and shower heads. In addition to improving the unit quality and comfort for tenants, these upgrades will reduce the owners’ operating costs. Explains Mr. Thomas, “Especially for new investors, it’s so important to focus on making your building more efficient. If you don’t get a handle on water or energy costs, those costs add up and can really reduce your bottom line.”

An energy retrofit can reduce gas, electric, and water usage up to 30%.

That’s up to $10,000 in annual savings for a typical 24-unit building. CIC’s flexible energy loan options will fit your needs – and help you start saving. Bundle energy conservation expenses into an overall acquisition/rehab or refinance loan to finance your practical retrofit work: replace a boiler, improve air sealing and insulation, install a high-efficiency water heater, and more. Receive a free comprehensive building assessment and access to utility grant funds through CIC’s Energy Savers program.

Term

10 years

Amortization

25 years

Loan-to-value

Up to 90%

Debt coverage

1.15 minimum

Security

First mortgage on the property

Prepayment

No prepayment penalty

Recourse

Full recourse to the borrower

Service area

Chicago, suburban Cook County, DuPage, Kane, Lake, McHenry, and Will counties.

Featured Project

- Six units in Chicago’s southwest side

- Rehab loan and utility rebates

In May 2018, Marcia Ellis took on management of her father’s 6-flat on the southwest side of Chicago. The building had considerable deferred maintenance and Ms. Ellis was new to property management. To educate herself, she attended CIC’s property management training to gain the necessary tools to be successful.

CIC staff also encouraged Ms. Ellis to undertake a free energy assessment by CIC’s partner, Elevate Energy. She applied and got several recommendations, the most substantial being a boiler replacement.

Ms. Ellis received almost $45,000 in upgrades, including insulation, LED lighting, and boiler replacement, leading to a savings of $2,400 annually in energy costs.

Because the incentives available for the energy efficiency measures were so generous, she was able to devote loan proceeds to deferred maintenance and keep her monthly payments affordable.

For this CIC borrower, energy efficiency pays the bills

The following article was originally published in Northern Illinois Real Estate magazine.

This CIC borrower for a 12-unit Blue Island building was a small, private developer working in and around Chicago. He originally sought an acquisition loan only, with no rehabilitation work, for the occupied, 3-story brick walk up building.

After receiving the free energy assessment from Elevate Energy he decided to install new, high-efficiency central heating and domestic hot water systems. Out of a total cost of $49,775, Illinois energy efficiency programs covered 40 percent of the cost. CIC’s Energy Savers second mortgage covered the remaining $29,775.

The utility cost savings from the new equipment added $3,000 to the expected net operating income (NOI) without upgrades. That extra income from utility savings allowed the owner to comfortably pay the additional $2,100 in debt service for the improvements, while reaping the long-term benefits of increased cash flow and improving the building’s health and comfort for its tenants.

Feeling priced out of strong markets? CIC’s low-cost Mezzanine Debt offers flexible financing options for developers looking to purchase or refinance existing rental properties in higher-cost markets. With our new lower rates and accommodating loan terms, we encourage prospective clients to contact us directly to take advantage of CIC’s Mezzanine Debt Loan product.

Contact Senior Loan Officer Rosamond Meerdink to learn more.

Term

10 years

Amortization

Interest only (for mezzanine debt)

Loan-to-value

Up to 90%

Prepayment

No prepayment penalty

Eligible Properties

Existing, functioning multifamily rental buildings

Low-cost construction loans for local owner-developers to rehab or build new homes in Woodlawn.

Available for both multifamily rental and single-family, 2-4 unit for-sale projects.

CIC administers the SRO Preservation Loan Program authorized under a Chicago City Council ordinance passed in April 2022. Under this program, CIC provides construction loans to new buyers or existing owners of SRO housing. After construction is complete, up to $15,000 per unit will be paid off using City of Chicago grant funds.

Program details:

- Up to $15,000 of grant assistance per SRO unit on eligible projects

- Grant funds not to exceed 50% of total development costs

- Acquisitions costs within one year of closing can be included in the total development cost

- Units subject to affordability restrictions for 15 years

- Additional eligibility and program requirements may apply

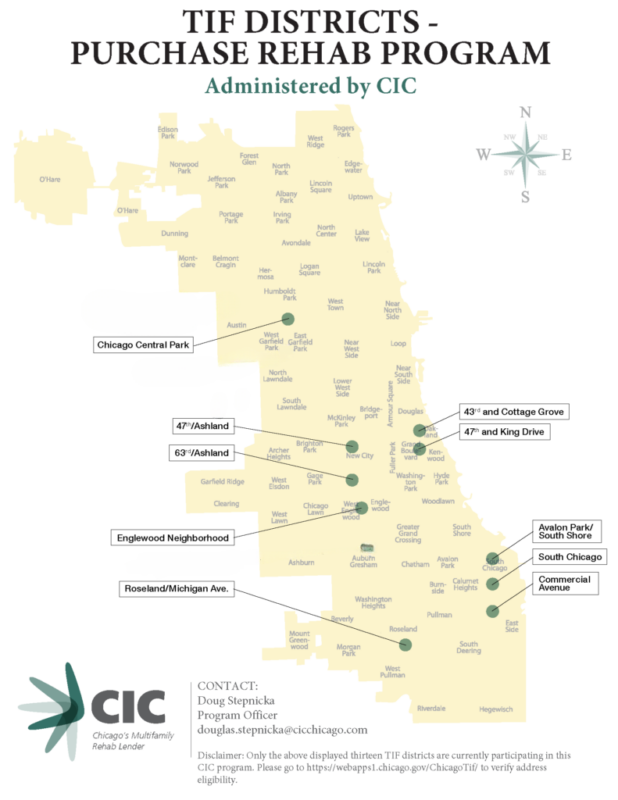

TIF Purchase Rehab grant funds are available to cover up to 50% of total development costs for eligible projects within designated TIF districts. Contact CIC to learn more.

Get started

How to apply

We’re excited to partner with you on your rental project. Whether you’re looking to purchase, rehab, refinance, or make energy efficient improvements, we have a lending solution for you. Our loan officers will work with you throughout every step of the process.

Contact a loan officer

We’re ready to talk to you about your next project. Call us at 312.258.0070 or email us at lending@cicchicago.com.

Download application

View and download the CIC loan application and supporting materials.

Submit application

Once you’ve worked with a loan officer, completed loan applications can be emailed to lending@cicchicago.com or submitted below.

Loan Application and Supporting Materials

View and download the CIC loan application and supporting materials. Completed loan applications can be submitted to lending@cicchicago.com

Loan Application Materials

Loan Processing Guidelines & Submission Checklist